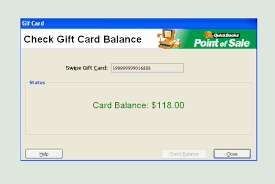

I have seen this inquiry previously yet have not had the option to apply it to my circumstance. I have a POS at my café running Breadcrumb (observe). I can sell QuickBooks gift card vouchers at my POS, or Online. I use Shogo so as to import my everyday deals from POS into QB.

At the point when the Gift card is obtained at the POS, I get a credit brought the following day into QB for Sales and a charge for the installment technique (ex: card or money). As of right now, QuickBooks Online customer service has no clue about the gift voucher, it just considers it to be a deal that was not saddled. Presently the client comes to recover a segment of the gift voucher, he buys a menu thing that expenses $6.61 and charges $.59, so a sum of $7.20. The following day, we get a credit imported for Sales once more (which sounds to me like a copy) yet in addition duty will be credited right now, and a charge for Gift Cards Tender strategy (on the off chance that I make a QB record called Gift Cards, at present I don’t have one). What kind of record should this be? It can’t be an obligation since, well it’s not, I don’t owe them $7.20, I’m getting it.

Presently for the online gift vouchers. At the point when it is obtained, I get an installment of everything. On the off chance that somebody buys a $25 gift voucher on the web, I will get $25 to my financial balance.

So fundamentally its two Enquiries for Quickbooks Gift Card:

1) What kind of record would it be a good idea for me to make Gift Cards as? Salary?

2) Am I dealing with this appropriately? Are deals really being copied or is this right?

3) Is there something else I’m feeling the loss of that I may have ignored?

My underlying supposition will be that I’m recording the underlying acquisition of the gift voucher erroneously, and this ought to be a risk, not a deal. On the off chance that I record the underlying buy as a Gift Card Liability, I would then be able to deduct this record with the recovery. I believe that would really fathom it, however since I’ve worked this one out, would someone be able to confirm?

Sell and reclaim QuickBooks gift card vouchers or declarations Online

At the point when you acknowledge installment for a blessing endorsement, you acknowledge the risk to recover the blessing testament sooner or later. So as to satisfy that commitment and track the exchange in QuickBooks Online, you have to set up an obligation record and uncommon things to use on a blessing authentication receipt.

To sell a blessing declaration

- Select the Plus symbol (+) at the top, at that point Sales Receipt.

- Enter one line for Gift Certificates. This Gift Certificates Product/Service can be connected to a risk account on the off chance that you need to follow it as an obligation.

- Indicate into which record the cash got for the blessing authentication is going, just as how it will be stored.

To reclaim a blessing authentication

- Select the Plus symbol (+) at the top, at that point Invoice.

- On the mainline, select the Product/Service being purchased and round out the amount and sum.

- On the subsequent line, select the Product/Service for QuickBooks on gift card Certificates (the one connecting to a risk account), and enter in a negative number for the measure of the blessing testament.

- On the off chance that the measure of the blessing endorsement is more than the measure of the buy, you can either give the client money or credit.

To give the client a credit

- Select the Plus symbol (+) at the top, at that point Credit update.

- In the first line(s), enter in the Products/Services being bought. Rather than entering a positive-sum (5.00) enter in a negative-sum (- 5.00).

- In the last line, select the Product/Service you are utilizing for Gift Certificates. Enter a positive-sum.

- On the off chance that there is a charge on this deal, enter it in as a negative-sum. The sum in the Total Credit field will indicate how the credit sum the client has left from the Gift Certificate.

Meaning of Gift Certificates

Blessing authentications (and gift vouchers) are frequently sold by a retailer to a purchaser for money. The purchaser would then be able to reclaim the blessing declaration or offer it to someone else who can recover the blessing testament for products or administrations.

Representing the Sale of QuickBooks Gift Certificates

The clearance of a blessing endorsement ought to be recorded with a charge to Cash and a worthy representative for a risk record, for example, Gift Certificates Outstanding.

Note that income isn’t recorded now. Or maybe, the retailer is recording its commitment/obligation to give product or administrations to the measure of the authentication sold.

Conclusion:

At the point when a blessing declaration is displayed to the retailer, income will be recorded by the retailer for the measure of product or administrations that were given. This is finished with a charge to the obligation record QuickBooks gift card Certificates Outstanding and a good representative for an income account QuickBooks customer service.

Our clarification relates to budgetary bookkeeping. To find out about the annual duty treatment of this exchange, you should look for guidance from an assessment proficient or go to www.irs.gov.

Tags: creditonlinequickbooks gift cardQuickBooks online supportrecord