With a credit card, you can do a lot more than just shopping. You must choose a card based on your usage patterns. If you are a cinema enthusiast or visit theatres often, make sure to avail a credit card that offers special offers, discounts, and vouchers on movie tickets. Opting for a free movie ticket credit card seems a smart move from your part.

Take a look at what movie credit cards have to offer

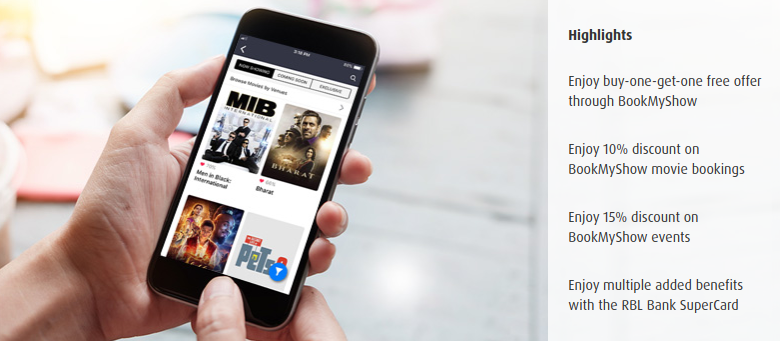

Offers from BookMyShow

Cardholders can enjoy buy-one-get-one-free ticket offer when they book tickets from BookMyShow app or website. This offer is applicable only for select financial institutions on their credit cards. Note that they may even be available on specific theatres.

For instance, if you use a Bajaj Finserv RBL Bank SuperCard, you can use this exclusive offer twice a month based on the SuperCard type you choose. You can also enjoy an additional 10% discount on all your bookings via BookMyShow with a SuperCard. Further, you also get to enjoy a 15% discount on BMS events with this free movie ticket credit card.

In addition to this, the existing customers of Bajaj Finserv can avail of the benefits of pre-approved offers which streamline the process of availing such financial products. These offers are applicable to credit cards as well as on personal loans, business loans, home loans, among numerous other financial products. By sharing a few necessary details, you can check your pre-approved offer.

Miscellaneous offers on movie tickets

With some of the best free movie ticket credit cards, offers are not limited to movie bookings. Some of them include up to Rs. 55,000 savings per year along with nominal joining and renewal fees.

With the best movie credit card, one can also enjoy an interest-free personal loan up to 90 days and interest-free cash withdrawals from ATMs for up to 50 days. Further, one can also convert significant purchases (over Rs. 3000) into easy installments. With offering extending to gadgets and apparel, a free movie ticket credit card like SuperCard caters to all.

The advantages of the Bajaj Finserv RBL Bank credit card extend beyond reward points and vouchers. SuperCard holders get to enjoy robust security features to keep their finances secure.

Moreover, you can avail the service of a virtual credit card to access your card – anywhere, anytime. Further, you enjoy zero-fraud liability cover as well. Acquiring 20,000 reward points as a welcome gift and reward points on every purchase – SuperCard is redefining the way movie credit cards operate.

As for how to use a credit card reward points, here is a step-by-step guide to redeem points:

-

Catalogue

Some providers provide a catalogue of merchandise which you can shop by using your reward points. These include goods and services such as gadgets, apparels, salon services, appliances, free or discounted movie tickets, etc.

-

Vouchers

Card users can also exchange their reward points for vouchers which you can use to purchase at various offline and online partner stores. The vouchers come in different denominations, as per the number of points they have to redeem.

This is one way how to use a credit card reward points. You, too, can benefit from numerous credit card features by applying for a credit card online easily.

-

Cash

Some card issuers allow their users to convert their reward points into cash. You can now use this cash to make purchases and payments or pay off your outstanding credit card bill.

-

Miles

Credit card issuers might also have tie-ups with airlines and travel companies and allow you to convert reward points into air miles. You can use these air miles to pay for flight tickets, upgrade your seats or avail rebates.

In the present financial market, financial institutions and NBFCs are competing to provide with the best of the credit card to their customers. Always weigh your options and opt for a card that is not only the best free movie ticket credit card but also suits best for all your expenditure.

Tags: Best Movie Credit CardsBest Movie Credit Cards in IndiaMovie Credit CardsMovie Time